Manara Capital investment company

Producing superior returns for all stakeholders through truthful dealings

About usFounded in 2005, Manara Capital is a privately-owned investment firm. It is governed by the Farra family.

Our family has a history in mercantilism, most recently expressed through being a founding partner in Capital Guidance, a 50-year old multi-family global investment company.

Our approach

Turning great ideas

into thriving businesses

We develop innovative and viable ventures, through strategic business partnerships and investments that add value to the global business sector across different areas and various industries.

Driving change

with consistent support

We established ourselves as a differentiated investor, through driving change within the marketplace, and providing strong and consistent support to portfolio companies, believing in their potential.

Embracing professional

excellence & leadership

We are proud to reach professional excellence by adopting a transparent and professional approach in our business practices and dealings, helping to build the skills of tomorrow.

A selection of our current investments

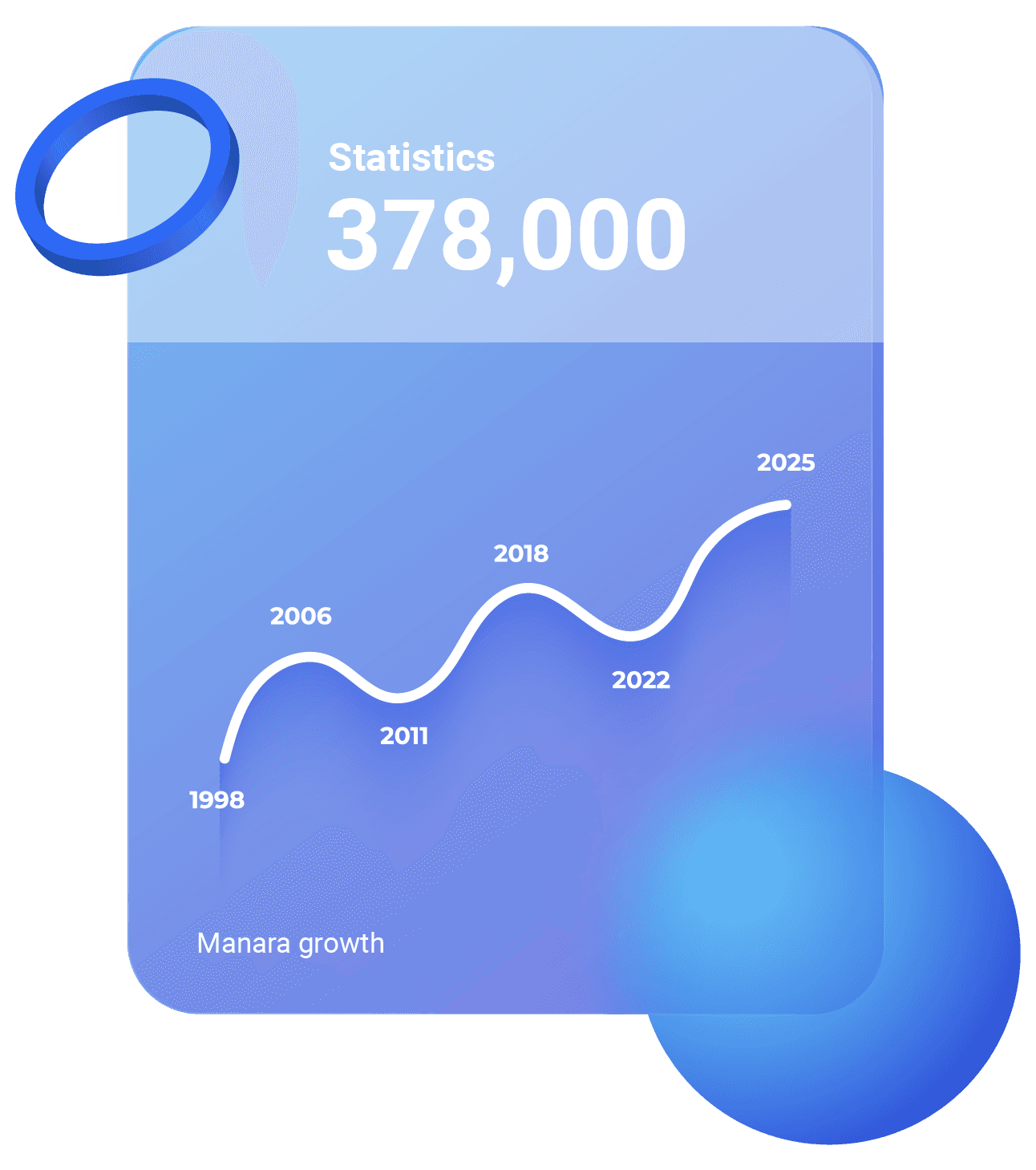

Key growth overview

Basic metrics of our diverse investment portfolio

We boast a portfolio of 52 investments across sectors like Financial Services, Real Estate, and more. Our investments include active and exited positions, direct and minority holdings, and both liquid and non-liquid assets.

Manara Capital governance

Karim Farra

(Check LinkedIn)

Karim Farra

Karim led Manara Capital from the start growing the firm into a diversified portfolio of operating companies...

Hazem Farra

(Check LinkedIn)

Hazem Farra

Hazem has oversight responsibility for Manara Capital. He has 30 years of global experience in operating businesses...